[ad_1]

INQ FILE PHOTO

MANILA, Philippines—Over a 12 months after lawmakers and progressive teams slammed the Supreme Courtroom (SC) choice that allowed Manila Electrical Firm’s (Meralco) energy charge hike in 2013, the distributor faces one more sequence of accusations amid rising energy charges.

In a privilege speech delivered final Nov. 7, Santa Rosa Metropolis Rep. Dan Fernandez made a number of allegations in opposition to Meralco, together with:

- Refusing to recompute its weighted common price of capital, which he claimed was too excessive and handed on to its prospects.

- Sustaining a monopolistic franchise that controls 70 % of the electrical energy in Luzon.

- Exercising anti-competitive habits.

READ: Meralco’s capital price too excessive, handed on to prospects – Home rep

A number of different lawmakers echoed Fernandez and referred to as for a assessment of Meralco’s franchise amid rising electrical energy charges. Shopper advocates additionally harassed that energy charges ought to be on a downward trajectory.

Whereas Meralco denied what it described as “baseless” accusations thrown in opposition to the utility, Fernandez’s criticism of the ability distributor — regardless of being referred to as out for some factual errors in his speech — has reignited a earlier controversy and different points linked to Meralco, which, as information exhibits, could proceed to persist as much as this present day.

What went earlier than

In 2013, Bayan Muna and the Nationwide Affiliation of Electrical energy Customers (Nasecore) challenged the ability charge hike permitted by the Power Regulatory Fee (ERC), citing lack of due course of and ERC’s grave abuse of discretion.

A major improve in energy charges in Metro Manila and close by provinces was famous in December 2013, with a further P800 per kWh invoice, representing a 61 % improve from the November 2013 common.

The hike, amounting to P22.64 billion, was not for extra electrical energy utilization however for prices which Meralco stated it incurred for buying costlier electrical energy from the Wholesale Electrical energy Spot Market (WESM).

The projected technology price for November 2013 was anticipated to rise to P7.86 per kWh.

To mitigate this improve, Meralco proposed to ERC a technology cost of P7.90 per kWh in December 2013 as a substitute of the particular P9.1070 per kWh.

This proposal meant deferring assortment of P3 billion of the full P22.64 billion technology price to February 2014 billing. The ERC permitted Meralco’s staggered cost scheme on December 9, 2013, however denied the request to cost carrying prices.

On April 22, 2014, the Supreme Courtroom issued an indefinite momentary restraining order (TRO) in opposition to the speed hike. Oral arguments had been carried out on January 21, February 4, and February 11, 2014.

Speedy approval

Voting 6-5, the excessive courtroom final 12 months dominated that there was no grave abuse of discretion on the a part of ERC when it permitted a gradual improve of P7.67 per kilowatt hour (kWh) for the December 2013 billing and ordered a further P1.00/kWh improve within the February 2014 billing.

The SC additionally dismissed the separate petitions filed by Bayan Muna and the Nationwide Affiliation of Electrical energy Customers for Reforms (Nasecore), arguing that there was a scarcity of due course of when ERC gave its approval.

Nonetheless, Bayan Muna appealed to the SC to rethink its choice, saying that the excessive courtroom ought to have a second have a look at the case.

Former Bayan Muna consultant Carlos Isagani Zarate argued that whereas the SC stated there was no abuse on the a part of ERC, they maintained that the approval was completed in haste.

READ: Bayan Muna appeals SC ruling permitting Meralco to get better P22.64B by energy charge hikes

On Dec. 5, 2013, Meralco wrote the ERC asking for authority to stagger the technology price for the availability month of November 13. The ERC permitted Meralco’s request after just one working day.

Citing the opinion of Affiliate Justice Amy Lazaro-Javier — who voted no on the gathering of technology prices — Bayan Muna stated, “the circumstances ought to have compelled the ERC to conduct a sturdy investigation on the matter as a substitute of rapidly appearing in favor of Meralco’s letter.”

In the meantime, the Advocates of Science and Know-how for the Individuals (AGHAM) expressed its dismay over the choice, saying customers are being abused by Meralco and the technology firms enabled by the legislation privatizing the ability trade.

“With the Supreme Courtroom choice upholding Meralco’s declare of ₱22.64 billion from the customers, the federal government continues to guard not the customers, however the vitality personal firms from their abuses,” stated Jona Yang, AGHAM Secretary Basic.

Excessive capital prices

Whereas the earlier charge hike was attributed to the acquisition of costlier gasoline for energy technology, lawmakers at present attribute the continued improve in charge hike to weighted common price of capital (WACC) that’s too excessive — which is then handed on to prospects.

The WACC is a share that determines how a lot return an organization ought to be getting to make sure the viability of its investments. A better WACC means an organization must make extra revenue to make sure operations, whereas a decrease WACC signifies that it wants solely decrease revenue to maintain operating.

By way of its impression on customers, a excessive WACC signifies that customers could expertise larger prices for the corporate’s services or products. However, a low WACC means customers could profit from extra secure or decrease costs for the corporate’s services or products.

Meralco spokesperson Joe Zaladarriaga, nevertheless, clarified that the ability distributor “has no energy to find out the weighted common price of capital (WACC)” as it’s a perform of the ERC.

Meralco defined that the final permitted WACC, 14.97 % set in 2010, was the bottom given by the regulator, which it stated utilized to all personal distribution utilities and never solely Meralco.

It added that it had not had “a decided WACC since July 2015 as a result of there was no accomplished charge reset throughout that regulatory interval up till now.”

READ: Meralco exec calls ‘overcharging’ accusation ‘baseless’

Growing charges

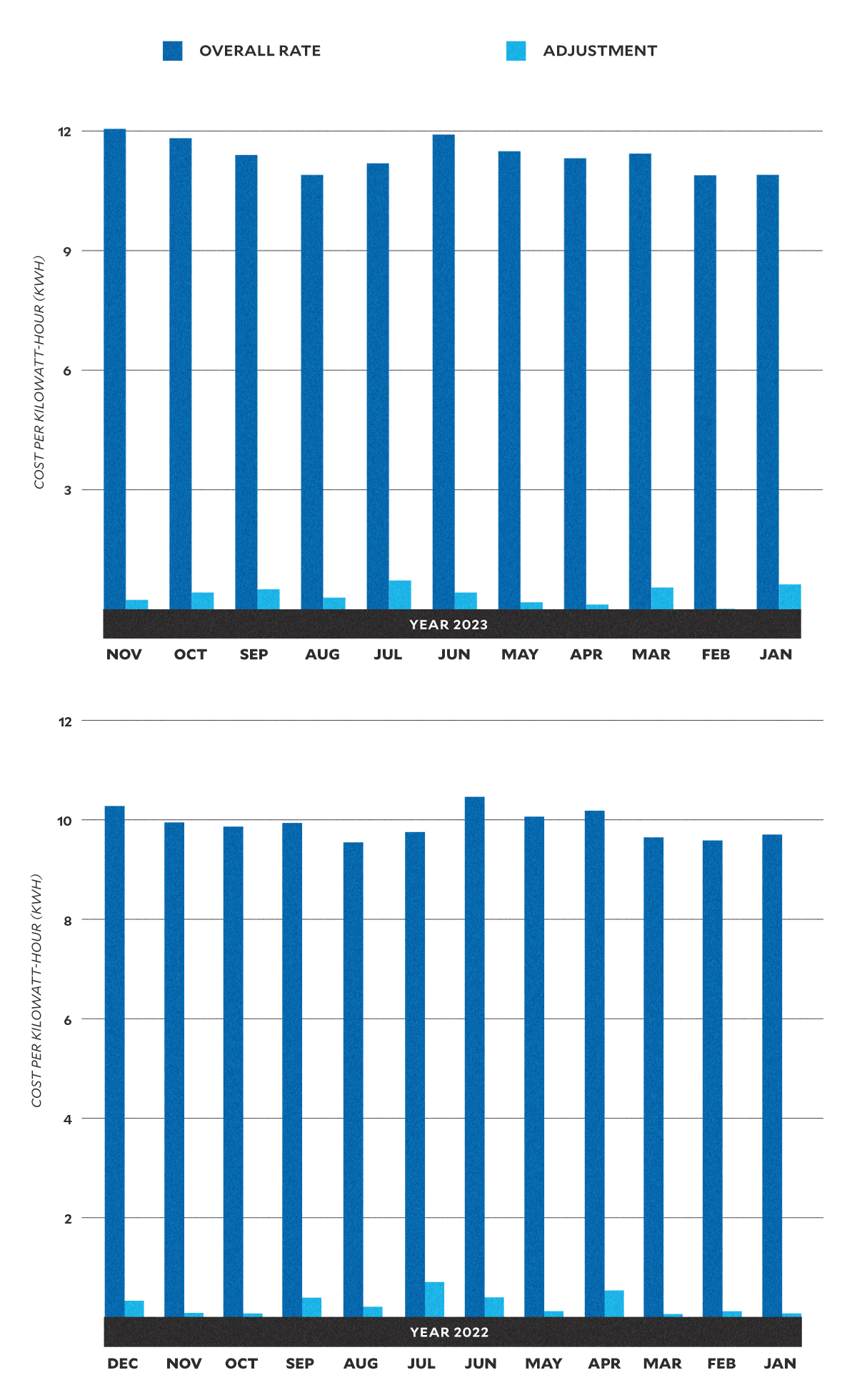

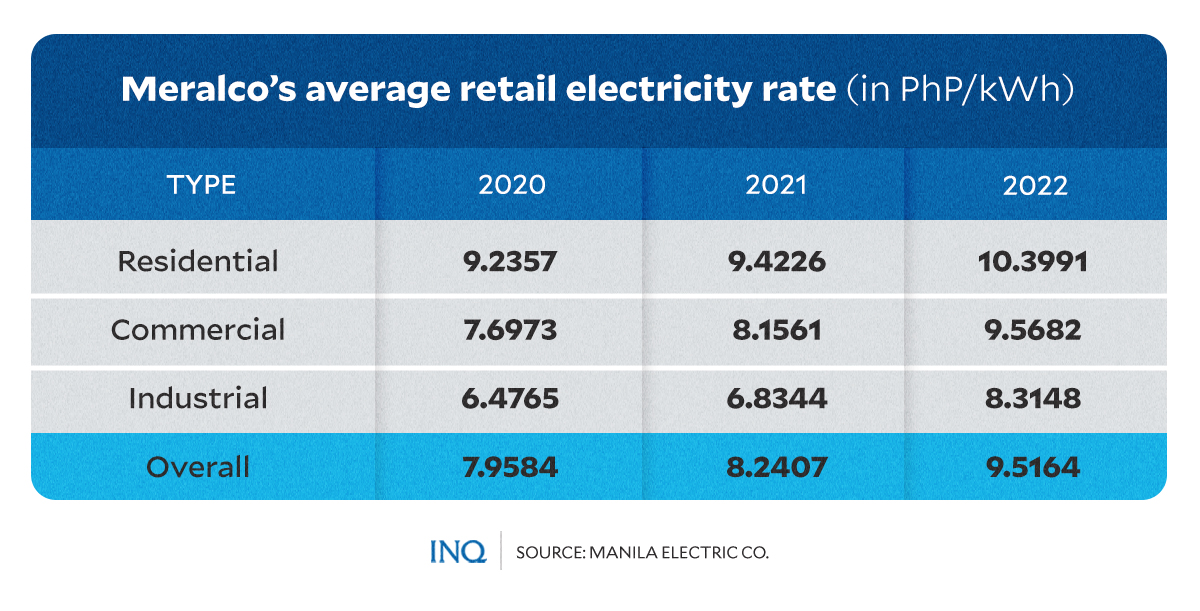

Knowledge from Meralco confirmed that from 2020 to 2022, the typical retail electrical energy charge elevated by 13 % for residential prospects — from P9.2357 per kWh to P10.3991 per kWh.

In line with Meralco, the elevated charges in 2022 had been because of larger technology and transmission expenses with the spike in demand for energy attributable to the reopening of the nation’s economic system in 2021 following the COVID-19 pandemic.

It added that the battle in Ukraine aggravated the scenario resulting in the unprecedented spike in gasoline costs, which additionally prompted the upper costs in WESM.

In April final 12 months, the general charge for a typical family went up by P0.5363 to P10.1830 per kWh in comparison with the earlier month’s charge of P9.6467 per kWh. It was equal to a rise of round P107 within the whole invoice of a residential buyer consuming 200 kWh.

The ability distributor attributed the speed hike to larger expenses from Unbiased Energy Producers (IPP) and the WESM.

Knowledge additionally confirmed that the general charge for residential prospects continued to extend since 2022, regardless of Meralco implementing decrease charges in February, April, August, and most notably in July, which noticed a lower of round P144 within the whole electrical energy invoice of residential prospects consuming 200 kWh.

GRAPHIC Ed Lustan

From P10.9001 per kWh in January this 12 months, the general charge for a typical family shot as much as P12.0545 per kWh as of November.

Shopper advocate Romeo “Butch” Junia harassed that energy charges within the franchise space being serviced by Meralco ought to be on a downward development “because the legislation granting the utility the franchise to provide electrical energy mandated that it accomplish that ‘at least price’.”

READ: Shopper advocate says energy charges ought to be on downward trajectory

“However as a substitute of the charges normalizing, or declining, they’ve taken an upward trajectory that will present the mandate for ‘least price’ isn’t being adopted,” stated Junia, who had been concerned as an intervenor in circumstances filed on the ERC associated to energy charges.

“The truth is, in lots of ERC choices when price or charge is roofed, ERC appears inclined to push charges up as an incentive to utility. My place is the franchise by itself is an incentive, and it ought to encourage the utility to maintain inside the least price. Sadly, ERC doesn’t appear to take that view. I’m wondering,” he added.

Prospects get ‘zero’ profit

Meralco attributed the upward changes of the general charge for residential prospects these previous months to will increase in transmission expenses, in addition to upticks in technology expenses and different expenses on particular months.

Nonetheless, Junia argued that the rising electrical energy charges had been because of the energy distributor’s failure to think about shopper welfare in its apply of “economies of scale,” or the precept in enterprise that will decrease prices as its shopper base grows.

“Normally in economies of scale, as we perceive it, the bigger you develop, the decrease is your price, so how come the gargantuan franchise of Meralco has not been capable of profit us,” stated Junia.

“As a substitute of inverse proportion the place the larger the dimensions, the decrease the associated fee, it turned the alternative the place a rise in charges adopted a rise in enterprise,” he added.

The continual charge will increase, Junia defined, contradict the anticipated development of reducing prices as an organization’s buyer base expands.

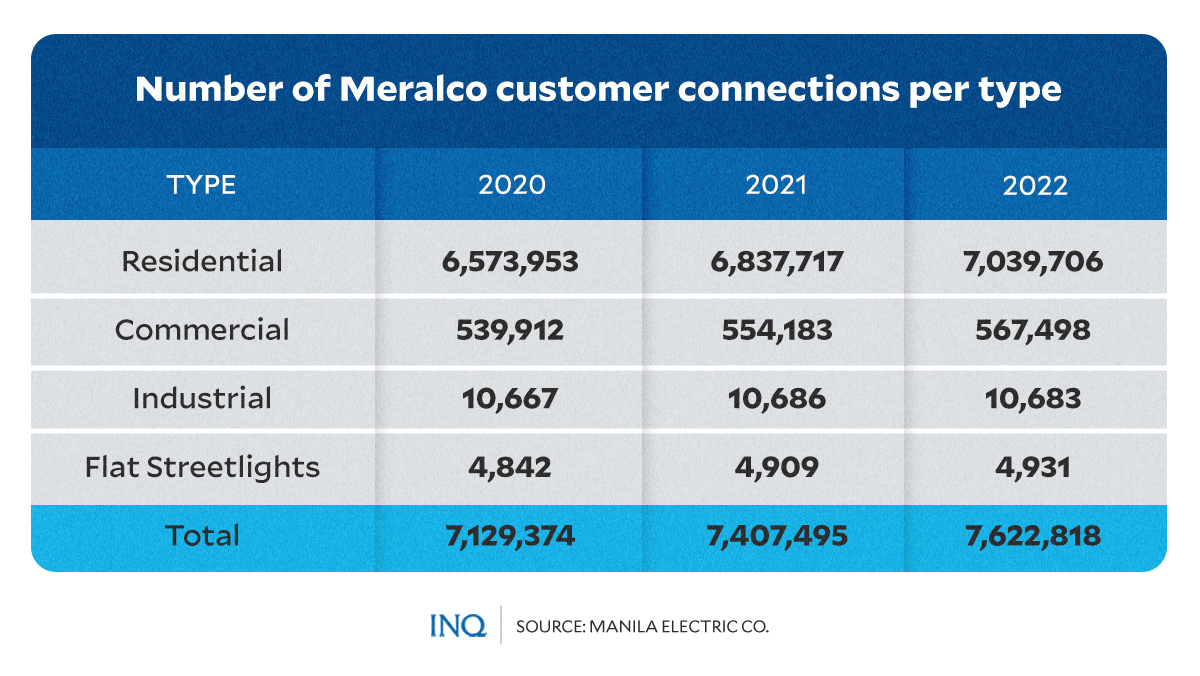

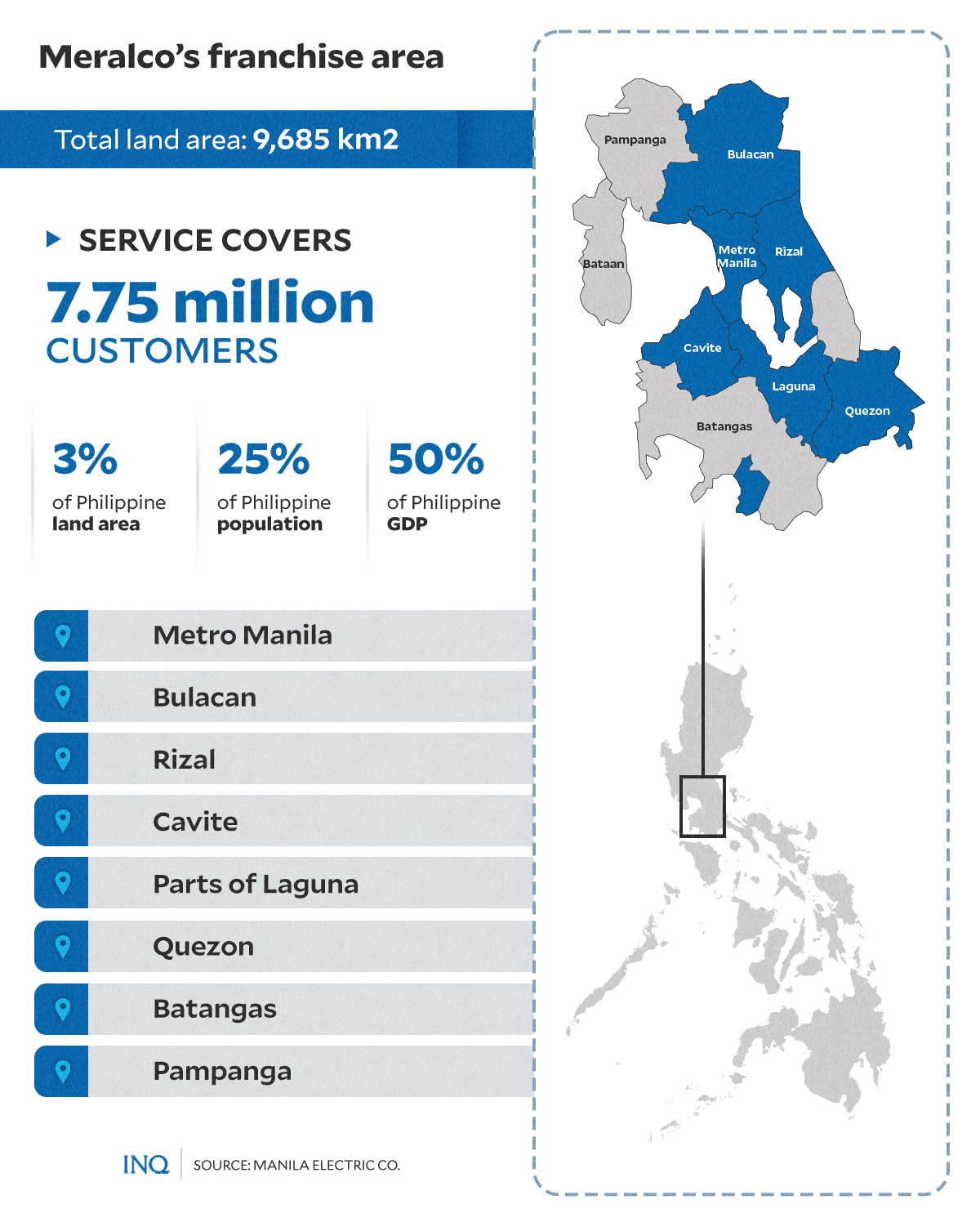

Meralco is the most important private-sector electrical distribution utility within the nation, protecting 39 cities and 72 municipalities. Whereas its franchise space of over 9,685 km2 corresponds to solely 3 % of the full land space within the nation, it accounts for 55 % of the Philippines’ electrical energy output.

From 2020, Meralco’s buyer connections elevated by no less than 9 % — from 7.13 million to round 7.75 million this 12 months. Final 12 months, Meralco’s residential prospects reached 7,039,706.

Junia famous the disparity between Meralco’s important progress within the Nationwide Capital Area (NCR) and the shortage of a corresponding lower in costs. Citing the rise in charges from PHP0.79 per KWH underneath the Return on Fee Base (RORB) to PHP1.35 per KWH at present, he argued that Meralco is working at an uneconomically massive scale.

He additionally highlighted the sharp improve in Meralco’s internet earnings, from PHP2.7 billion to over PHP20 billion, indicating a profitable enterprise scale-up however not in favor of shopper prices.

Present combine, excessive producing prices

In a report, Greenpeace and the Heart for Renewable Power and Know-how (CREST) highlighted the advantages of decarbonizing and shifting to renewable vitality (RE), corresponding to having decrease technology prices by the 12 months 2030.

“The report exhibits how Meralco stands to profit from shifting to RE, as it will drive down their technology prices by 17.58 %,” stated CREST president Rei Panaligan.

The lower in technology prices attributable to shifting to RE would profit each Meralco and its customers.

“Decarbonizing Meralco is a win-win answer for each the corporate and its shareholders in addition to electrical energy customers as it is going to decrease prices, improve potential revenue, and handle the local weather emergency and associated harms coal and fossil gasoline use inflict on communities,” Greenpeace stated.

READ: Breaking our backs: SC OKs added Meralco charges for ‘soiled’ energy sources

Nonetheless, the report harassed Meralco’s continued dependence on fossil fuels or “soiled energy sources,” particularly coal.

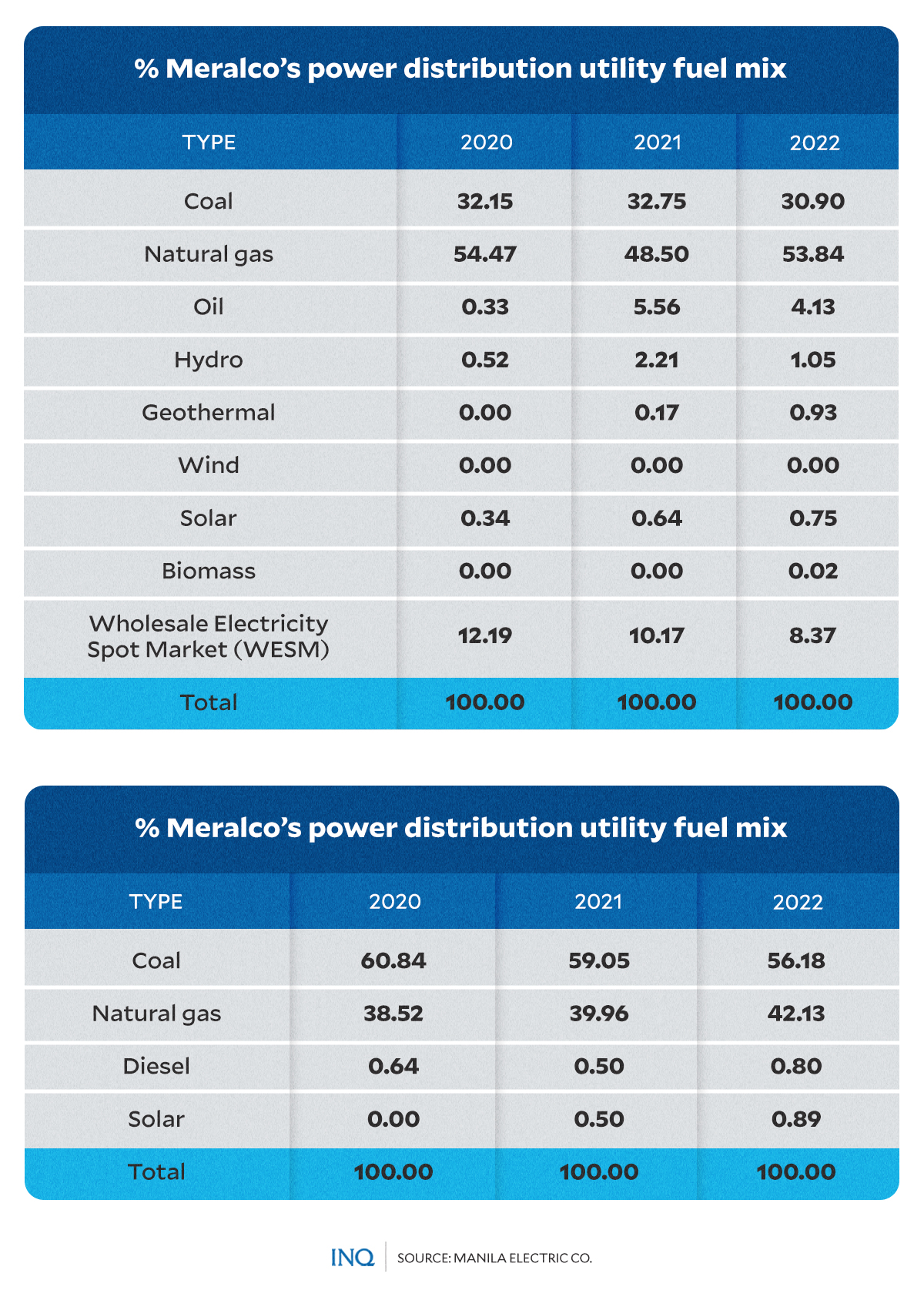

Knowledge from Meralco confirmed that in 2022, over half, or 53.84 %, of its energy distribution utility gasoline combine was from pure gasoline. About 30.90 % was in the meantime sourced from coal purchases.

Fossil fuels likewise made up many of the 2022 energy mixture of Meralco PowerGen Company (MGen), an entirely owned subsidiary of Meralco — coal (56.18 %) and pure gasoline (42.13 %).

In line with MGen president and chief govt officer Jaime Azurin, the mother or father firm goals to scale back direct emissions by 20 % by 2030 and grow to be coal-free earlier than 2050.

“We’ll proceed to work with the vitality trade, authorities, and different pertinent stakeholders to assist additional speed up the nation’s vitality transition as we aggressively pursue extra renewable vitality initiatives. That is consistent with Meralco’s long-term sustainability technique to embark on a simply, reasonably priced, and orderly transition to wash vitality,” Azurin stated.

Via MGen Renewable Power, Inc., or MGREEN, a subsidiary of MGen, Meralco additionally seeks to increase its ventures into renewable vitality and buildup to determine 1000 MW of renewable vitality capability for the following 5-7 years.

Nonetheless, Greenpeace argued that whereas Meralco has laid out plans to diversify its vitality portfolio by venturing into renewable vitality and vitality storage, it continues to construct extra coal-fired energy vegetation.

The group stated it appears to be “a sign that the corporate doesn’t see any urgency in investing extra aggressively in renewables as a means of serving to hold the nation’s commitments underneath the Paris Settlement.”

Questions on transparency

Apart from denying accusations corresponding to Meralco’s supposed refusal to recompute its WACC and sustaining a monopolistic franchise, Zaldarriaga likewise stated there was no abuse of market energy.

“Data likewise present that Meralco is totally compliant with all authorities laws and even outperformed the extent of service required by the regulator. That is exactly the explanation why some native authorities models are clamoring for Meralco to take over their service,” Zaldarriaga stated.

“Additional, whereas Meralco is the most important utility within the nation, it has by no means dedicated and has no report of any anti-competitive habits or abuse of market energy,” he went on.

“Quite the opposite, now we have at all times managed to provide electrical energy to our prospects in essentially the most clear and least price method, and is the one distribution utility that has complied with an ERC directive to refund distribution expenses by refunding greater than 48 billion pesos in 2023,” he added.

Nonetheless, Junia belied Meralco’s declare of being at all times clear, saying that it has, in all circumstances, “thwarted all motions for manufacturing of paperwork, on one pretext or one other.”

He additionally famous that the ERC has persistently dominated in favor of Meralco.

“If that’s transparency, I don’t know what opaque is. If that’s truthful regulation for customers, I don’t know what unfair is,” stated Junia.

“I hope the brand new ERC underneath the current chair vigorously pursues the ideas laid down within the newest NGCP ruling, the place prices for 2015 to 2022 to be recoverable should cross the factors of restoration (prudent, cheap, essential, recurring and redounding to shopper profit) based mostly on precise and historic prices as verified and validated,” he added.

Cross-ownership limitation

One other concern beforehand identified by lawmakers questioning Meralco’s compliance with current authorities laws was the ability distributor’s alleged means across the cross-ownership limitation of personal energy companies, as acknowledged in Part 45 of the Republic Act (RA) No. 9136 or the Electrical Energy Trade Reform Act of 2001 (EPIRA).

Part 45(b) of EPIRA states that energy sectors are allowed cross-ownership. It additionally states:

“For the aim of stopping market energy abuse between related companies engaged in technology and distribution, no distribution utility shall be allowed to supply from bilateral energy provide contracts greater than fifty % (50%) of its whole demand from an related agency engaged in technology however such limitation, nevertheless, shall not prejudice contracts entered into previous to the effectivity of this Act.”

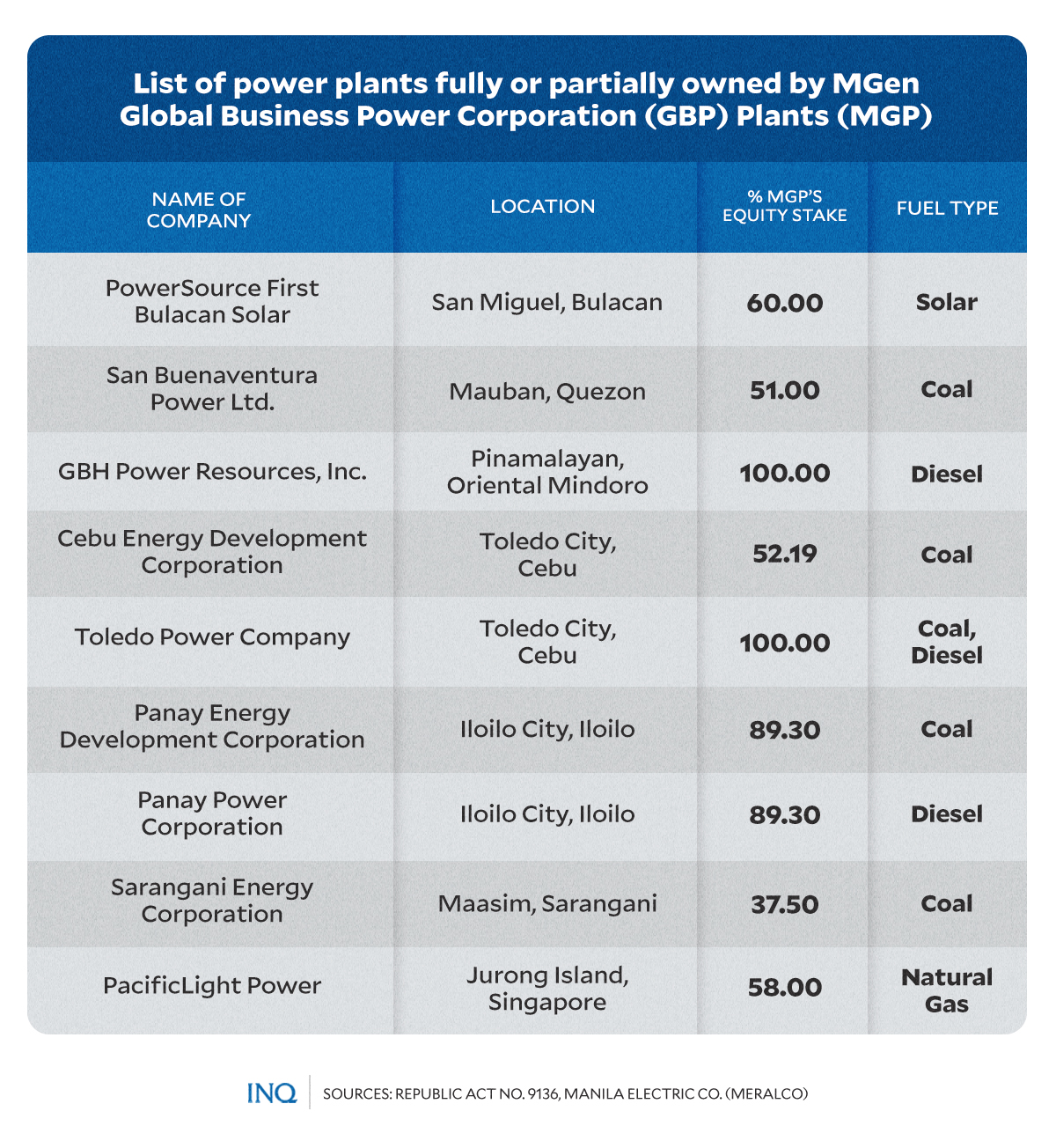

Nonetheless, based on a measure filed final 12 months by representatives of the SAGIP party-list, Meralco was allowed to “circumvent the already beneficiant cross-ownership limitation within the EPIRA.”

Home Invoice (HB) No. 174, authored by Representatives Caroline Tanchay and Rodante Marcoleta, aimed to amend the EPIRA legislation. They argued that:

“Part 4(b), Rule 11 of the Implementing Guidelines and Regulation of the EPIRA unduly expanded the idea of the bounds on the focus of possession by redefining ‘management’ because the ‘entity controlling the phrases and situations of the costs or portions of the output of such capability bought available in the market’ as a substitute of’ ‘the ability to direct or trigger the path of the administration insurance policies of an individual by contract, company or in any other case’ in Part 45 of the EPIRA.”

“As an example, the Manila Electrical Firm (Meralco) is understood to be the largest

distributor of electrical energy in Luzon. Meralco, by its Powergen Company (MGEN) can

simply be categorized as an vitality cartel,” they stated, including that the ability distributor has possession within the following:

- 51% of the 455MW San Buenaventura Energy Plant enlargement in Mauban, Quezon

- 100% of the World Enterprise Energy Company (GBP), GBP in flip, owns 50% curiosity in Alsons Thermal Power Corp. (ATEC)

- ATEC, in flip, holds 75% curiosity in Sarangani Power Company’s 237MW coal-fired energy plant in Sarangani and a 120MW coal-fired energy plant in Zamboanga.

In 2017, electrical customers with civil society teams bared that based mostly on Meralco’s 2016 Annual Report, its energy provide settlement (PSA) companions are literally their subsidiaries, associates and/or three way partnership companions.

READ: Customers, civil society teams rap Meralco on ‘sweetheart’ offers

“That is nothing however a transparent connivance between Meralco and the stated technology firms—a deal made out of mutual advantages and equal alternate of favors, similar to how ‘sweethearts’ do,” stated Erwin Puhawan of the Freedom from Debt Coalition (FDC).

“If the PSAs would push by, Meralco would have freedom to train affect over the price of each the technology and the distribution of electrical energy,” he added.

‘Apply vitality effectively’

Amid the continued discussions attributable to the continual improve in energy charges, Meralco urged the general public to apply vitality effectivity to raised handle their electrical energy consumption.

“Some vitality saving ideas that prospects can apply embody unplugging home equipment when not in use, common cleansing of air conditioner filters to optimize its use and utilizing LED bulbs for cost-saving lighting,” Meralco stated.

“Meralco prospects may also have higher management of their month-to-month electrical energy payments with the assistance of the Meralco Cellular App Equipment Calculator that gives info on the vitality consumption of home equipment and devices,” it added.

RELATED STORIES:

ERC in limelight as lawmakers search pause to energy provide bidding

2 extra Home members echo Fernandez’s rant vs Meralco

Rep. Rodriguez to shopper advocates: Give attention to bringing Meralco charges down

MGen allots P18B to increase RE portfolio

[ad_2]