[ad_1]

Editor’s word: This story led off this week’s Larger Training publication, which is delivered free to subscribers’ inboxes each different Thursday with tendencies and prime tales about increased schooling.

To Florina Caprita, the mom of three younger kids, the paralegal research program at Ashworth Faculty appeared like the right path to a much-needed profession. The courses had been solely on-line, and an admissions officer advised her she might make small month-to-month funds towards the $4,465 tuition whereas she was taking courses, as a substitute of getting to pay it suddenly.

However in 2018, a household emergency pressured her out of college, simply six credit shy of her diploma. To make issues worse, she fell behind on her month-to-month funds, which had steadily elevated from $25 to greater than $200.

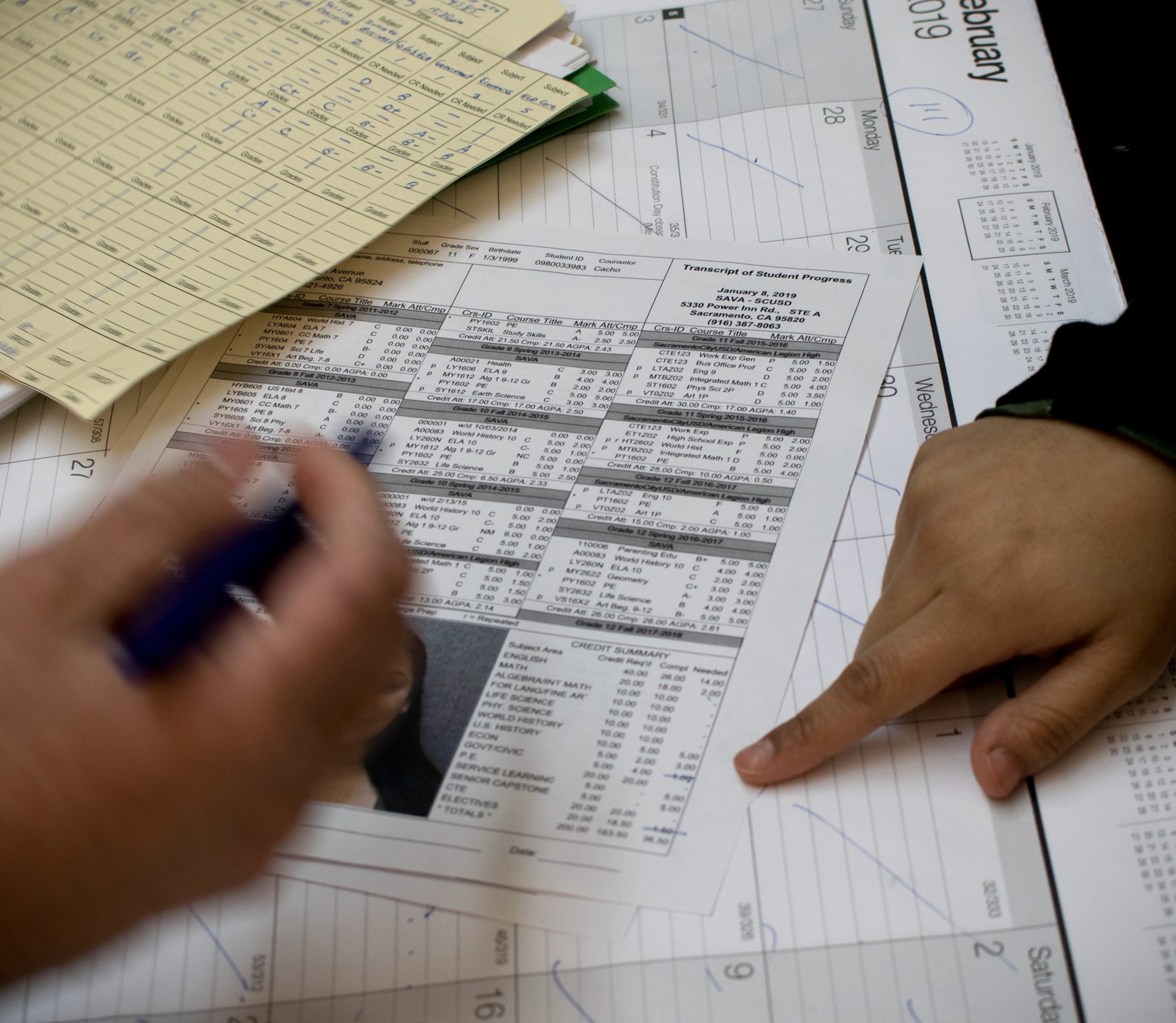

She struggled financially for a number of years as her well being declined, however final spring, she received a chance to earn a level at a unique faculty. The issue? Ashworth, an unaccredited, for-profit college in Georgia, refused to launch her transcript till she paid – in full – the greater than $2,200 that she owed them.

This follow, generally known as transcript withholding, has change into a rising fear for state and federal regulators. Critics say that it makes it tougher for college kids to earn a level or get a job, which might permit them to earn sufficient to pay again their money owed. However the system of oversight is patchwork; no single federal company bans it, state guidelines differ and there are important challenges with monitoring the follow. Meaning college students like Caprita can fall by the cracks.

In October, the Division of Training launched new guidelines that might bar schools from withholding a transcript for any semester for which a scholar used federal scholar help cash and paid their steadiness in full. The transfer was lauded by advocates as an enormous step ahead in eradicating the follow – however wouldn’t apply to any of the hundreds of colleges that don’t settle for federal scholar help to start with, together with Ashworth Faculty.

Specialists have lengthy criticized authorities for not offering higher oversight of those colleges.

“A few of these colleges exist that approach as a result of they’d by no means qualify, and that’s often as a result of they supply very low worth to college students, sadly,” mentioned Edward Conroy, a senior coverage advisor on the progressive assume tank New America. “Not in all circumstances, however quite a lot of these applications are usually not lifting individuals out of poverty, they’re not offering a path to center class jobs or middle-class revenue, and so I believe typically they’re of questionable worth.”

In contrast to the Division of Training, the Client Monetary Safety Bureau does have jurisdiction over schools that don’t qualify to obtain federal cash. And prior to now yr, the company has begun investigating schools for refusing to launch transcripts due to a mortgage steadiness owed on to the varsity.

“If they assist me, I might help to pay them. In the event that they withhold [the transcript] from me, then I how can I ever pay them?”

Florina Caprita, who has an excellent mortgage from an internet for-profit college

In 2022, the company discovered that transcript withholding was an abusive follow below the Client Safety Act, “designed to achieve leverage over debtors and coerce them into making funds.”

The CFPB has adopted a broad definition of what a scholar mortgage is. They embody in that class issues like cost plans, arguing that these are basically types of credit score. Cash owed for issues like unpaid room and board balances or overdue fines, nevertheless, will not be lined.

By their definition, Caprita ought to have been eligible to entry her transcript. However she says she referred to as and emailed the faculty repeatedly to no avail. She even requested to re-enroll in a brand new cost plan however faculty officers mentioned their palms had been tied and she or he must take up the matter with a set company.

“If they assist me, I might help to pay them,” mentioned Caprita, who’s 44 years outdated and is hoping to affix a Christian ministry. “In the event that they withhold it from me, then I how can I ever pay them?”

Ashworth Faculty didn’t reply to requests for remark.

A CFPB official acknowledged that it’s not possible to look at the insurance policies of all the hundreds of schools and universities throughout the nation. The bureau has tried to make sufficient public statements for establishments to take word and alter their insurance policies with out extra intervention, the official mentioned. The company has investigated some schools for transcript withholding and made them change their practices however has not launched any establishment names publicly.

The schooling division’s rule on transcript withholding will go into impact in July 2024, becoming a member of different federal and state laws meant to guard college students from transcript withholding.

An schooling division spokesperson mentioned that the company plans to regulate its oversight procedures to make sure that colleges that obtain federal funding are following new laws and that each one scholar complaints alleging transcript withholding are investigated. Colleges could finally lose eligibility to obtain federal scholar help in the event that they don’t adjust to the brand new rule.

“It wouldn’t fully shock me if one of many institutional reactions was, ‘We’re simply going to cease doing this, interval.’ ”

Edward Conroy, senior coverage advisor, New America

Even though the regulation solely applies to college students who’ve used federal cash to pay for his or her schooling, advocates hope that schools will reply in a broader approach.

“It wouldn’t fully shock me if one of many institutional reactions was, ‘We’re simply going to cease doing this era,’ ” Conroy mentioned. “The variety of college students who’re paying fully out of pocket isn’t that huge; you don’t need to have separate administrative programs.”

Certainly, that’s what some policymakers have seen occur on the state degree. Some states have solely banned the follow at public establishments or for money owed of as much as a certain quantity. In different circumstances, colleges are solely required to launch transcripts for sure makes use of.

As an example, in 2022, Colorado handed a regulation prohibiting withholding transcripts from college students requesting them for a number of causes together with needing to supply it to an employer, one other faculty or the navy. Carl Einhaus, a senior director on the Colorado Division of Training says that almost all establishments discovered it too burdensome to distinguish between which transcript requests had been required by regulation to be honored and which weren’t and have opted to grant all requests.

“They’re not going to trouble making an attempt to determine learn how to operationalize this very troublesome factor to operationalize,” he mentioned.

Beginning subsequent summer season, the Colorado regulation additionally requires establishments to submit knowledge about what number of college students requested transcripts and what number of had been withheld. Einhaus mentioned that some colleges initially resisted the brand new regulation, arguing that it will take away one in every of their fundamental instruments to recuperate cash owed from college students. “Will probably be fascinating to see if this actually is having an influence on the quantity of debt they’re in a position to accumulate again,” he mentioned.

However Brittany Pearce, a program supervisor on the increased ed consulting agency Ithaka S+R, is skeptical that withholding transcripts was ever an efficient solution to recoup debt. “From a extremely sensible enterprise sense, no person is successful,” she mentioned.

This story about transcript withholding was produced by The Hechinger Report, a nonprofit, impartial information group centered on inequality and innovation in schooling. Join for our increased schooling publication. Take a look at our Faculty Welcome Information.

Associated articles

[ad_2]