[ad_1]

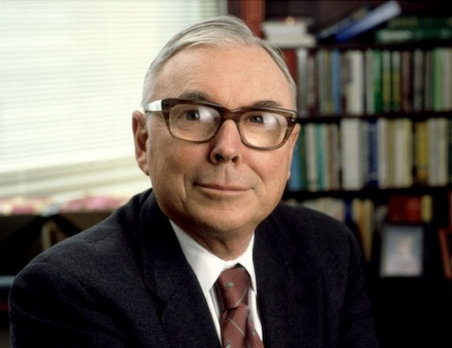

Charlie Munger, the person who helped Warren Buffett construct Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) into one of many largest firms on the earth, died on Tuesday in California on the age of 99. He would have turned 100 on Jan. 1.

“Berkshire Hathaway couldn’t have been constructed to its current standing with out Charlie’s inspiration, knowledge and participation,” Buffett mentioned in a press release.

Munger grew up in Omaha, Nebraska, and really labored at a grocery retailer owned by Buffett’s grandfather as a child. Nonetheless, the 2 legendary buyers didn’t meet till 1959 at a dinner when Munger was again in Omaha to take care of issues associated to his lately deceased father.

Previous to that, he had attended the College of Michigan, served within the Military Air Corps, and graduated from Harvard Regulation Faculty. In 1962, he moved to California and based a regulation agency, Munger, Tolles, and Olson, and spun off an funding agency, Wheeler, Munger and Co.

In an article he wrote for Columbia Enterprise Faculty Journal in 1984 referred to as “The Superinvestors of Graham-and-Doddsville,” Buffett highlighted Munger’s monitor report operating the portfolio at Wheeler, Munger.

“I bumped into him in about 1960 and instructed him that regulation was wonderful as a interest, however you are able to do higher,” Buffett wrote of Munger. “His portfolio was concentrated in only a few securities, and due to this fact, his report was far more unstable, nevertheless it was primarily based on the identical discount-from-value method. He was keen to simply accept better peaks and valleys of efficiency, and he occurs to be a fellow whose entire psyche goes towards focus.”

As Buffett identified within the piece, Munger’s portfolio had a median annual return of 19.8% from 1962 to 1975, in comparison with the Dow Jones Industrial Common’s acquire of about 3% per 12 months.

Someday round 1976, Munger joined Buffett at Berkshire Hathaway, and in 1978, he turned a vice chair, a place he held till he died. By the way, Berkshire Hathaway’s portfolio has posted a median annual return of 19.8% per 12 months from 1965 by way of 2022, in comparison with the S&P 500’s 9.9% annual return over that very same interval.

The wit and knowledge of Charlie Munger in Buffett’s personal phrases

When speaking about Berkshire Hathaway and their technique, Buffett sometimes says “Charlie and I,” which reveals simply how shut a partnership these two males had. Within the 2022 annual shareholders’ letter, which got here out this previous February, Buffett did it a number of occasions. Among the many many references, Buffett wrote, “Charlie and I should not stock-pickers; we’re business-pickers.”

In actual fact, Buffett credit Munger with refocusing his investing technique early on of their partnership, as he instructed CNBC in 2016.

“He weaned me away from the thought of shopping for very so-so firms at very low cost costs, figuring out that there was some small revenue in it, and searching for some actually fantastic companies that we might purchase in truthful costs,” Buffett instructed CNBC.

Within the final letter to shareholders launched in February, it was becoming that Buffett provided a tribute to Munger in a bit referred to as, “Nothing Beats Having a Nice Companion.” Yow will discover it on Berkshire Hathaway’s web site, nevertheless it appears applicable to recount right here as we speak.

“Charlie and I believe just about alike, however what it takes me a web page to elucidate, he sums up in a sentence,” Buffett wrote. “His model, furthermore, is all the time extra clearly reasoned and likewise extra artfully — some would possibly add bluntly — said. Listed below are a number of of his ideas, many lifted from a really latest podcast:

- The world is filled with silly gamblers, and they won’t do in addition to the affected person investor.

- When you don’t see the world the best way it’s, it’s like judging one thing by way of a distorted lens.

- All I need to know is the place I’m going to die, so I’ll by no means go there. And a associated thought: Early on, write your required obituary — after which behave accordingly.

- When you don’t care whether or not you might be rational or not, you received’t work on it. Then you’ll keep irrational and get awful outcomes.

- Endurance might be discovered. Having an extended consideration span and the power to focus on one factor for a very long time is a large benefit.

- You may be taught quite a bit from lifeless folks. Learn of the deceased you admire and detest.

- Don’t bail away in a sinking boat should you can swim to at least one that’s seaworthy.

- An ideal firm retains working after you aren’t; a mediocre firm received’t try this.

- Warren and I don’t give attention to the froth of the market. We search out good long-term investments and stubbornly maintain them for a very long time.

- Ben Graham mentioned, ‘Everyday, the inventory market is a voting machine; in the long run, it’s a weighing balance.’ When you preserve making one thing extra priceless, then some clever individual goes to note it and begin shopping for.

- There is no such thing as a such factor as a 100% positive factor when investing. Thus, the usage of leverage is harmful. A string of fantastic numbers occasions zero will all the time equal zero. Don’t depend on getting wealthy twice.

- You don’t, nevertheless, have to personal loads of issues in an effort to get wealthy.

- You must continue learning if you wish to grow to be an important investor. When the world modifications, it’s essential to change.

- Warren and I hated railroad shares for many years, however the world modified, and eventually the nation had 4 enormous railroads of important significance to the American financial system. We have been gradual to acknowledge the change, however higher late than by no means.

- Lastly, I’ll add two quick sentences by Charlie which were his decision-clinchers for many years: ‘Warren, assume extra about it. You’re good, and I’m proper.’

And so it goes. I by no means have a cellphone name with Charlie with out studying one thing, and whereas he makes me assume, he additionally makes me chortle.”

Buffett concluded the phase by writing: “I’ll add to Charlie’s listing a rule of my very own: Discover a very good high-grade associate — ideally barely older than you — after which hear very rigorously to what he says.”

Revealed First on ValueWalk. Learn Right here.

Featured Picture Credit score: From Twitter; Thanks!

[ad_2]